Fee Only, Comprehensive Approach

VCM’s top priority is to be fully aligned with our clients’ best interests. We are fee-only and hold ourselves accountable to our clients and provide the comprehensive wealth management that our clients need. Our firm is reviewed and GIPS© certified annually by an outside firm. What does GIPS mean?

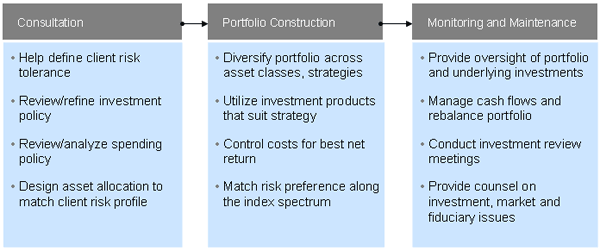

VCM Wealth’s investment philosophy is designed to address an investor’s desire to achieve sustainable portfolio returns over time with only as much investment risk as is necessary in each of our proprietary strategies. Our philosophy targets net portfolio returns over time that are considered generally necessary for an individual investor to maintain distributions in retirement, for endowments/pensions to meet spending goals in perpetuity, and for pre-retirees to achieve measurable progress toward saving goals. VCM Wealth combines three fundamental aspects to successful portfolio management:

“OUR APPROACH TO PORTFOLIO CONSTRUCTION”

VCM’s Implementation of our investment process is designed to be systematic in nature, objective, and most importantly is designed to produce performance characteristics that are predictable and repeatable during various market environments. The discipline seeks to efficiently balance investment risk with investment reward, systematically exposing investors to more growth oriented during periods of sustained market advances, and in turn to less volatile during periods of sustained market declines. Although VCM Wealth prioritizes risk and return management over tax efficiency, our experience has also helped high net-worth and high income investors successfully manage today’s complex tax code.

VCM Wealth has a measurable performance history through all three market environments (rising markets, falling markets and stagnant markets). This performance history is rigorously documented, and includes all necessary metrics for advisors and investors to objectively evaluate the benefits and limitations of the discipline.