Strategy Description

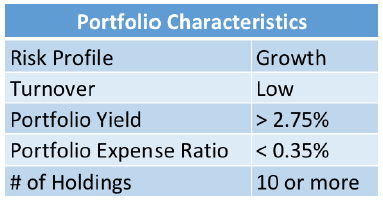

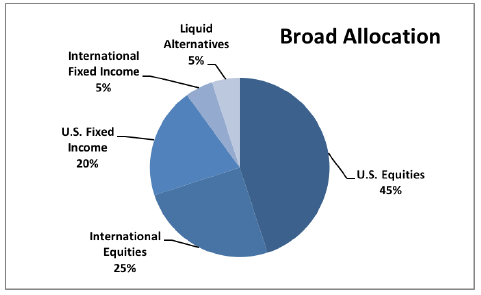

The Growth ETF Strategy’s main objective is to achieve a growth oriented return by investing in a combination of asset classes. The portfolio consists of multiple exchange traded funds (ETFs) and is invested through the use of a disciplined research process. The asset allocation of this model is a distinct and differentiating factor. The composite is allocated 70% to the global equity markets and 30% to the global fixed income markets. The inception date is July 1, 2009 with a creation date of January 1, 2015. The benchmark consists of 70% MSCI All World Index (net of all tax withholding), 30% Barclays US Aggregate Bond Index, blended monthly. The allocation may include ETF’s that invest in REITs, commodities, and liquid alternatives.

Please contact us for more information